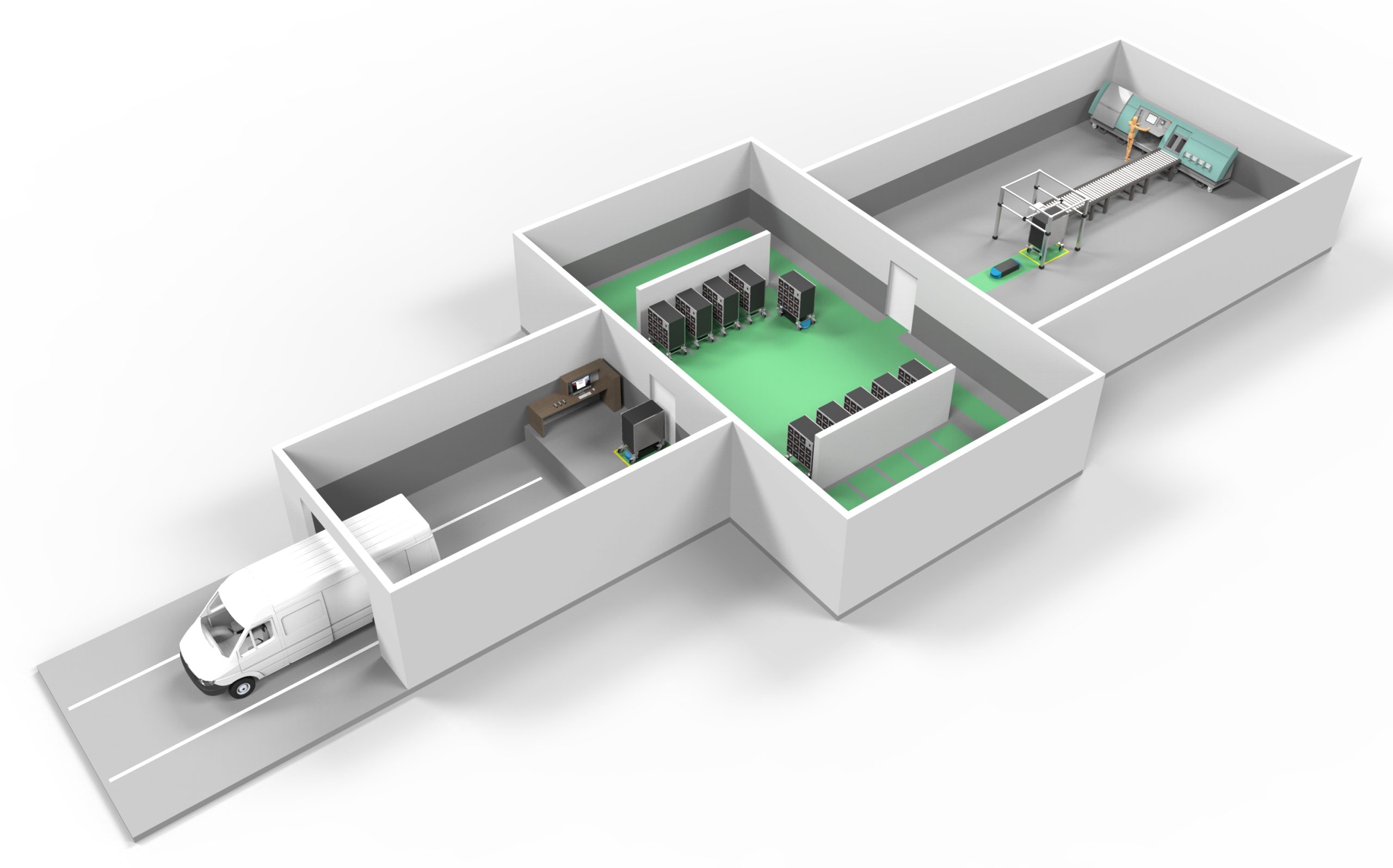

Starts at the Customer – Ends at the Cash Center

The future of cash might be closer than you think.

We’ll help you get there by reducing time, labor cost and closing the full cash cycle gaps every day.

–

Automated Cash Handling

The benefits of cash automation include reduced costs, increased speed of transactions, increased accessibility to cash (e.g., ATMs) and improved security and control of cash balances. Until recently, cash handling has been largely a manual and labor-intensive process.

Consultants for Automation and Logistics Center

Andy Villiger

Co-owner of Villiger Security Solutions AG, experienced working for SwissLog, NCR and many other logistics companies.

Cash Management

Cash Management has been in the stone age since the invention of Banknotes. Villiger can assist you step by step implementing automation to innovate your operation for a long term success of your business. Because cash usage remains strong, merchants, banks, and armored carriers are exploring ways to take advantage of new technologies to automate their cash handling functions.

Together with our partners and Villiger solutions we can overcome the problems that the cash industry is currently facing.

Automating Cash Management

Automating cash management reduces the possibility of accounting errors,

as well as other benefits such as:

1. Reduced Manual Labor and Increased Efficiency

Automating the cash management process ensures departments are not overworked to the point of making consistent errors. Automating the data collection process also speeds up cash reporting thus, increasing the efficiency levels of each department.

2. Real-time Insight

The ability to gain insight into cash positions and make accurate forecasts in real-time enhances the decision-making abilities. Automating data capture and analysis provides real-time insight and is one of the selling points of cash management Finance professionals can also leverage the real-time insight automating cash management provides to convince stakeholders to consider purchasing a digital transformation solution.

3. Ensures Business Continuity

Knowledge of the cash position of an enterprise is crucial in financial decision-making. Inaccurate cash management means a business is likely to over-extend itself financially, which leaves customers in a vulnerable position. Automated cash management tracks cash in transit, deposited cash, and the status of cash holdings to ensure a business can continue its operations from a healthy perspective financially.

4. Cost Reduction

Manual data collation processes are not only time-consuming, labor-intensive tasks, but they also consume scarce resources. Integrating automation to minimize the effects of manual cash management leads to substantial savings as the ROI includes efficiency, less labor expenditure, and increased accuracy. With our solution, clients can reduce operational costs by a minimum of 80%.

5. Higher Security

The implementation of Innovative and secure solutions not only helps the cash in transit, but also the customer. Time is security and time is profit. Shortening the handling including the loading and unloading of systems in vehicles.

6. Reduced Insurance cost

Reduce your insurance cost by implementation of a secure system from the customer up to the counting department. Intelligent Banknotes Neutralization Systems also known as IBNS are at the beginning of the evolution. The time has come to adapt to the needs of the customer and not only offer security as a solution.

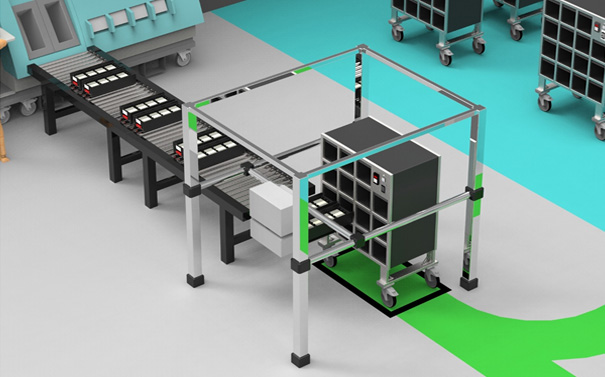

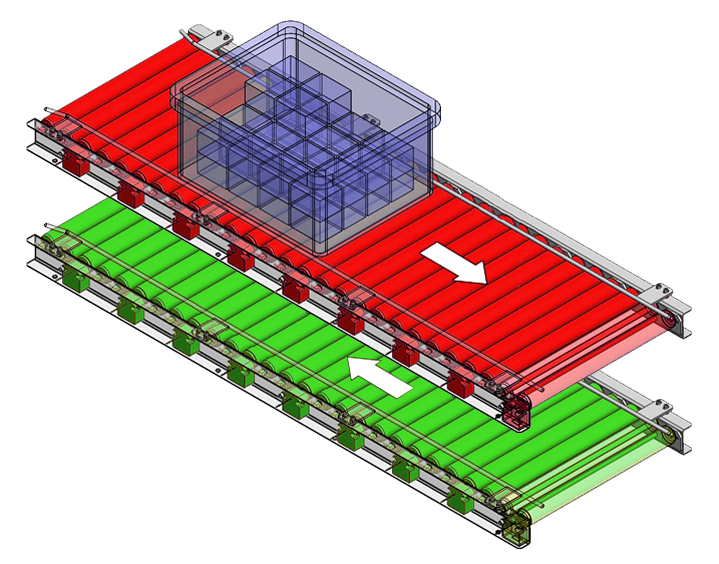

The Villiger Smart Tray

It’s all connected together

When you are on top of cash, business is good. Villiger helps you effortlessly to manage your full cash cycle with one solution.