Automation in the Cash Industry to secure Your Future

In banking, security is a top priority. In order to ensure the safety of their cash holdings and valuables at all times, banks need to retain full control over their cash handling and distribution processes. Automated systems reduce risks in banking and guarantee security, traceability and reliability.

A second wave of automation in banking will increase capacity and free employees to focus on higher-value projects. To capture the opportunity, banks must take a strategic, rather than tactical, approach.

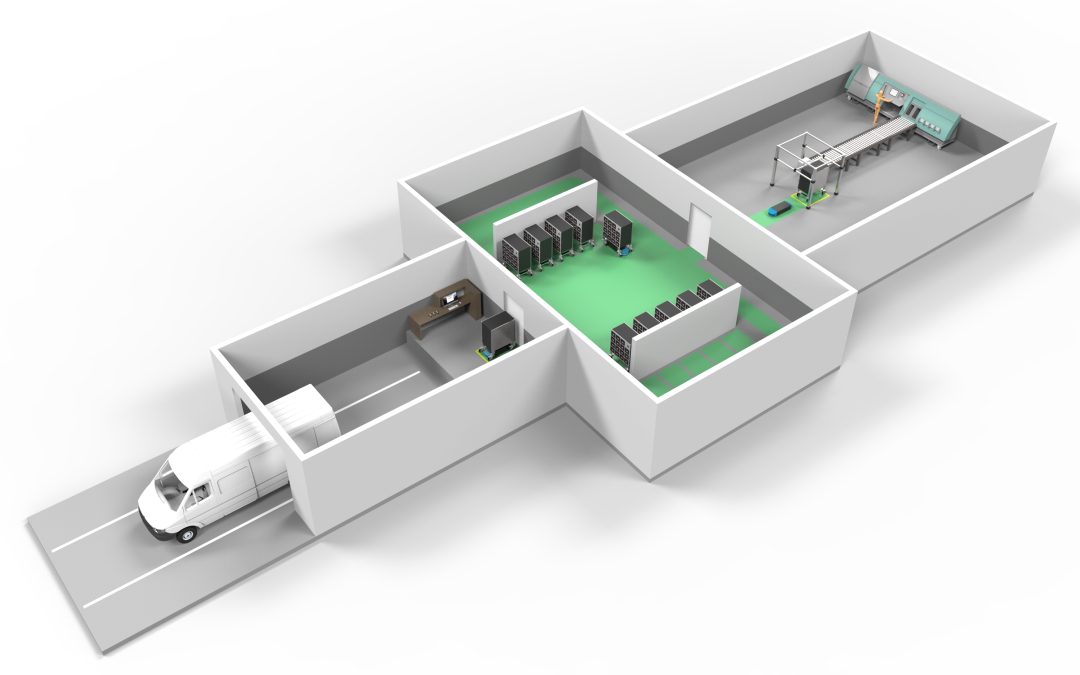

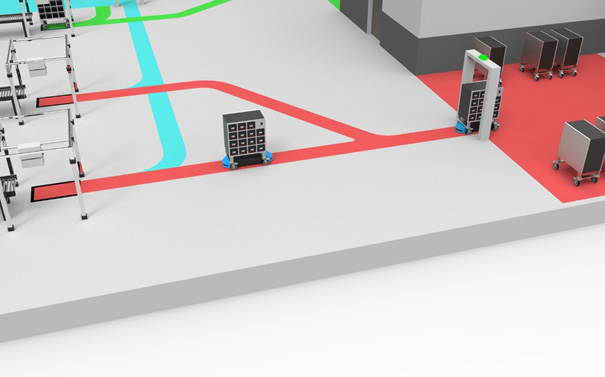

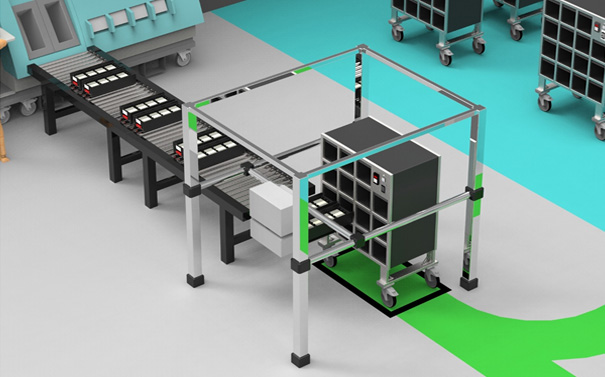

Automation is the focus of intense interest in the global cash industry. Many banks and CIT are rushing to deploy the latest automation technologies in the hope of delivering the next wave of productivity, cost savings, and improvement in customer experiences. While the results have been mixed thus far, we expect that early growing pains will ultimately give way to a transformation of markets, with outsized gains for the institutions that master the new capabilities. Automation only the cash counting process will not innovate the full cash cycle. This has been a bottle neck as Peter Villiger “CEO of Villiger Security Solutions AG” has mentioned many times. The industry needs to understand that automation needs to start with the customer and end at the cash center. The only way to fully benefit from automated processes, the full cash cycle has to be looked and work compatible with every section.

There are clear success stories, but many banks and CIT companies face sobering challenges. Some have installed hundreds of outdated equipment and still go through repeated tasks—with very little to show in terms of efficiency and effectiveness. Some have launched numerous tactical pilots without a long-range plan, resulting in confusion and challenges in scaling.

A second wave of new innovations and automated process is going to emerge in the next few years, in which machines will do up to 60 to 90 percent of work across bank and CIT functions, increasing capacity and freeing employees to focus on higher-value tasks and projects. To capture this opportunity, the industry must take a strategic, rather than tactical, approach. In some cases, they will need to design new processes that are optimized for automated/AI work, rather than for people, and couple specialized domain expertise from vendors with in-house capabilities to automate and bolt in a new way of working.

Villiger has been developing such innovative solutions for the past 2 years.

2023 will mark a new era for the cash industry in which our customers will overcome the problems and still be there to offer their services to their clients.